Analysis: Is this the beginning of the end for diesel cars?

Renault has become the latest car maker to cut a number of diesel models from its line-up as firms balance falling demand for the fuel and increasingly stringent emissions regulations.

This comes as figures reveal that the number of diesels on sale in the UK has nearly halved in the past five years.

Renault’s cull is so drastic that, by the end of this year, only one of its models – the Mégane hatchback/estate – will offer a diesel engine. The Kadjar SUV can no longer be ordered as a diesel, while such versions of the Clio supermini and Captur crossover won’t make it to 2021.

Earlier this month, Ford dropped diesel engines from the Fiesta range due to them taking less than 3% of sales, while even the fleet-friendly Mazda 6 will become petrol-only by the end of this year.

Data obtained by Autocar reveals that there were 493 diesel variants available to buy in the UK in November 2015. That includes all volume passenger cars, pick-up trucks and four-wheel-drive variants of the same engine but doesn’t include automatic variants.

That figure has fallen to 267 today (excluding variants due to be withdrawn in the coming weeks) and is continuing to fall.

A few brands, such as Alfa Romeo and Jaguar, have increased their range of diesel offerings during that period, but they’re in the overwhelming minority, as our table (below) shows.

Some of these drops aren’t surprising. Makers including Porsche, Toyota, Volvo and most Fiat Chrysler Automobiles brands have either ditched diesel entirely or intend to move away from it over the next couple of years. But even those that have previously stood by the fuel have shed variants, including BMW, Vauxhall and the majority of the Volkswagen Group brands.

Volkswagen – the focus of the Dieselgate emissions cheating scandal that began in 2015 – in particular has decimated its diesel offerings, getting rid of more than half.

Mercedes-Benz is the only big German brand to have maintained its diesel offerings in the past half-decade. CEO Ola Källenius said last year that he was “cautiously optimistic” about the fuel’s future, noting that it offers a 15-20% economy benefit over petrol. Mercedes is also attempting to further future-proof by expanding its range of diesel-electric plug-in hybrids – a powertrain no other manufacturer currently makes.

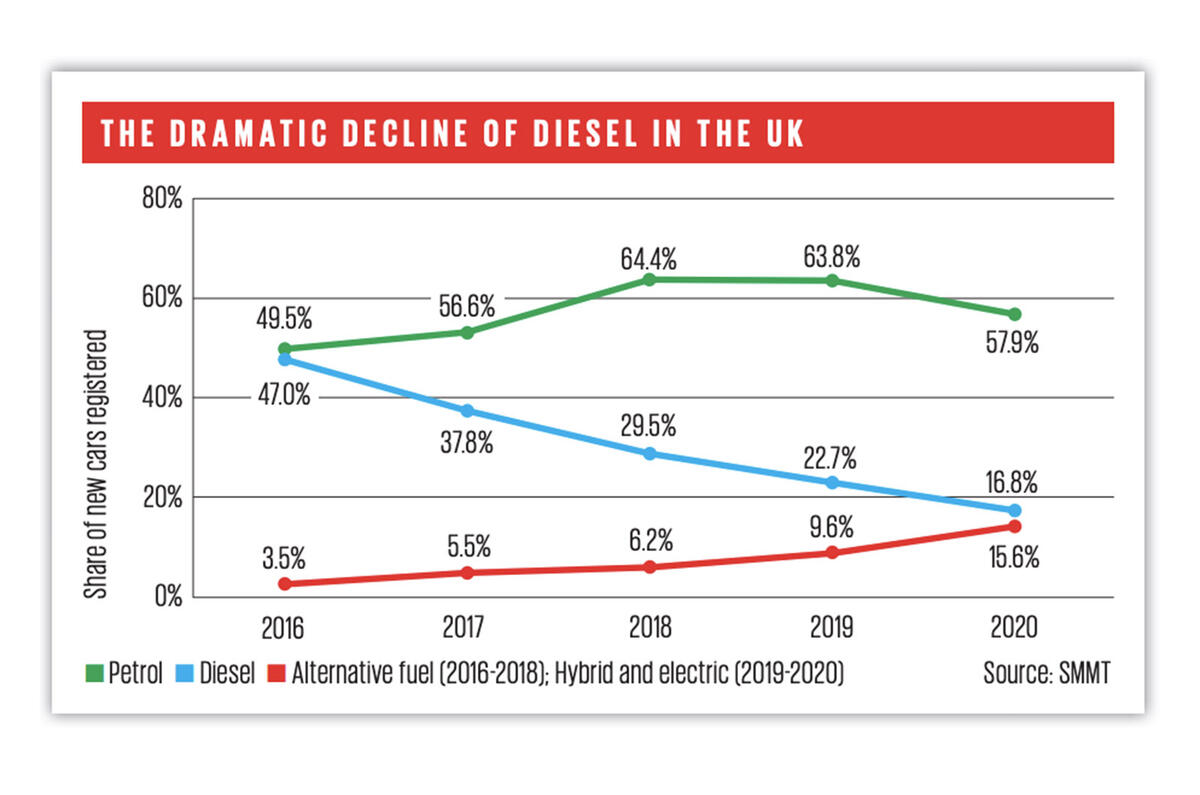

However, Mercedes is an outlier when you look at wider market trends. Data from the Society of Motor Manufacturers and Traders shows that of the 1.244 million new cars sold in the UK in 2020, just 209,000 have been diesels.

Diesel’s market share is down to a mere 16.8% so far this year, down from 25.7% in 2019. Five years ago, it had a touch under half the market.

There are multiple factors at play here, all influenced by one another. On the private buyer side, public attitudes towards the fuel have changed dramatically, bolstered by continuing government and local authority efforts to remove older diesel vehicles from urban areas and promote less polluting alternatives. On the fleet side, benefit-in-kind tax changes have increasingly encouraged business users into hybrid and particularly electric cars.

The effect on the industry is obvious: manufacturers are increasingly reluctant to spend huge amounts on developing diesel engines to meet ever more stringent European Union rules if that investment can’t be matched by sales revenue.

Can we finally conclude that the death of diesel is inevitable and imminent? The figures speak for themselves.